Over the past few years, Microsoft’s Power Platform has evolved rapidly. Analyze, Act and Automate are the simple words used to describe the broad capabilities provided by the tools within the Power Platform. Power BI (Analyze), PowerApps (Act) and Microsoft Flow (Automate) work together seamlessly to provide even users with very limited technical expertise the ability to build custom apps, automate workflows and analyze data for insights.

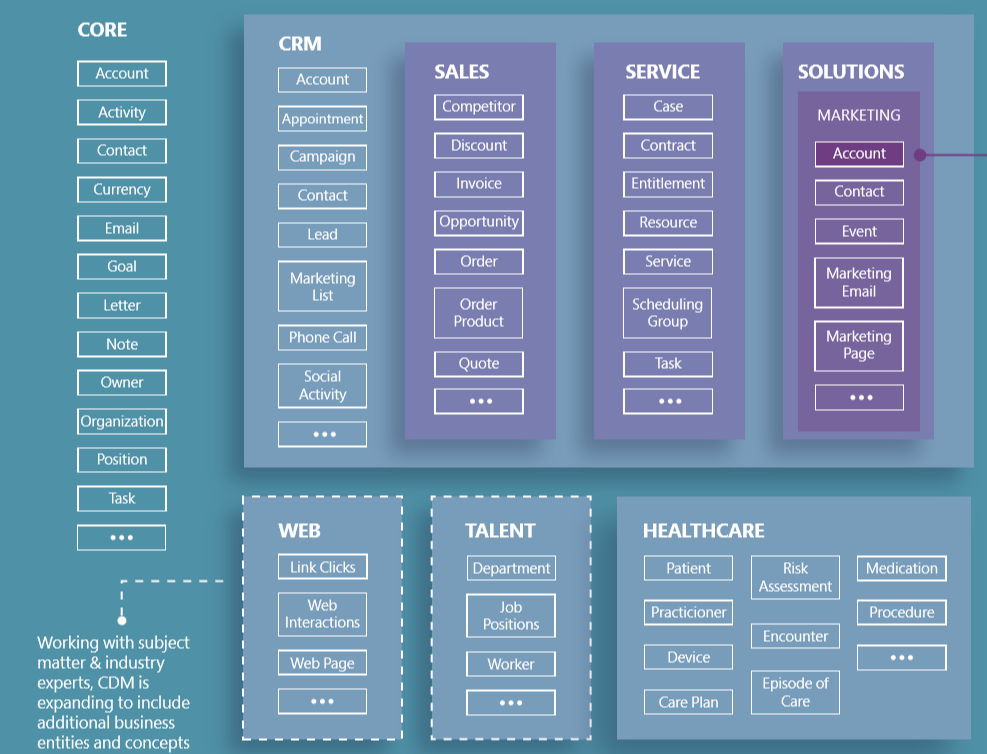

While the Power Platform can connect to many different sources and systems for data, Microsoft has been hard at work developing a standardized set of schemas for the Power Platform they call the Common Data Model. The Common Data Model is an open-sourced definition of standard (“core”) entities that represent commonly used concepts and activities. The Common Data Model simplifies data interactions by providing a shared data language for business and analytical applications to use. The Common Data Model metadata system enables consistency of data and its meaning across applications and business processes (such as PowerApps, Power BI, Dynamics 365, and Azure), which store data in conformance with the Common Data Model.

Per the below Common Data Model schema, the entities have grown tremendously since the CDM was first announced back in July of 2016. Recently, Microsoft also announced the release of new Industry Accelerators that extend the Common Data model to support a data schema specific to industries such as Automotive, Banking, Education, Healthcare, Media and Nonprofit.

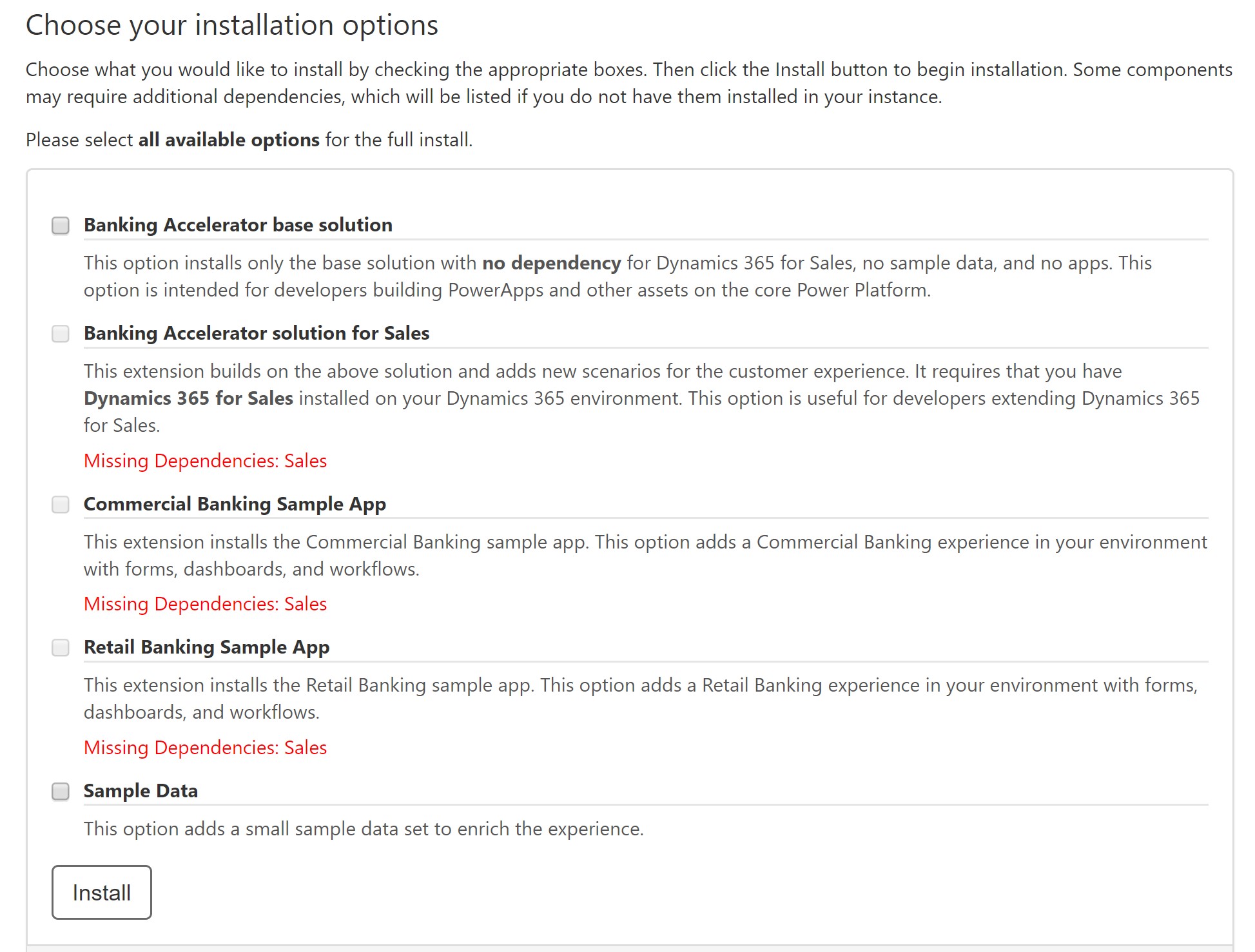

A specific Industry Accelerator I would like to showcase is the Banking Accelerator which is now generally available via Microsoft’s AppSource. This new accelerator extends the Common Data Model and contains a set of new entities to support a Financial Services Data Model designed for use in Retail and Commercial banking. The Banking Accelerator can be used with Dynamics 365 for Sales or it can also be used with a PowerApps instance. Microsoft has partnered with industry leaders such as Fiserv, VeriPark and Wealth Dynamix to ensure industry standards were followed during the creation of the new Banking Accelerator.

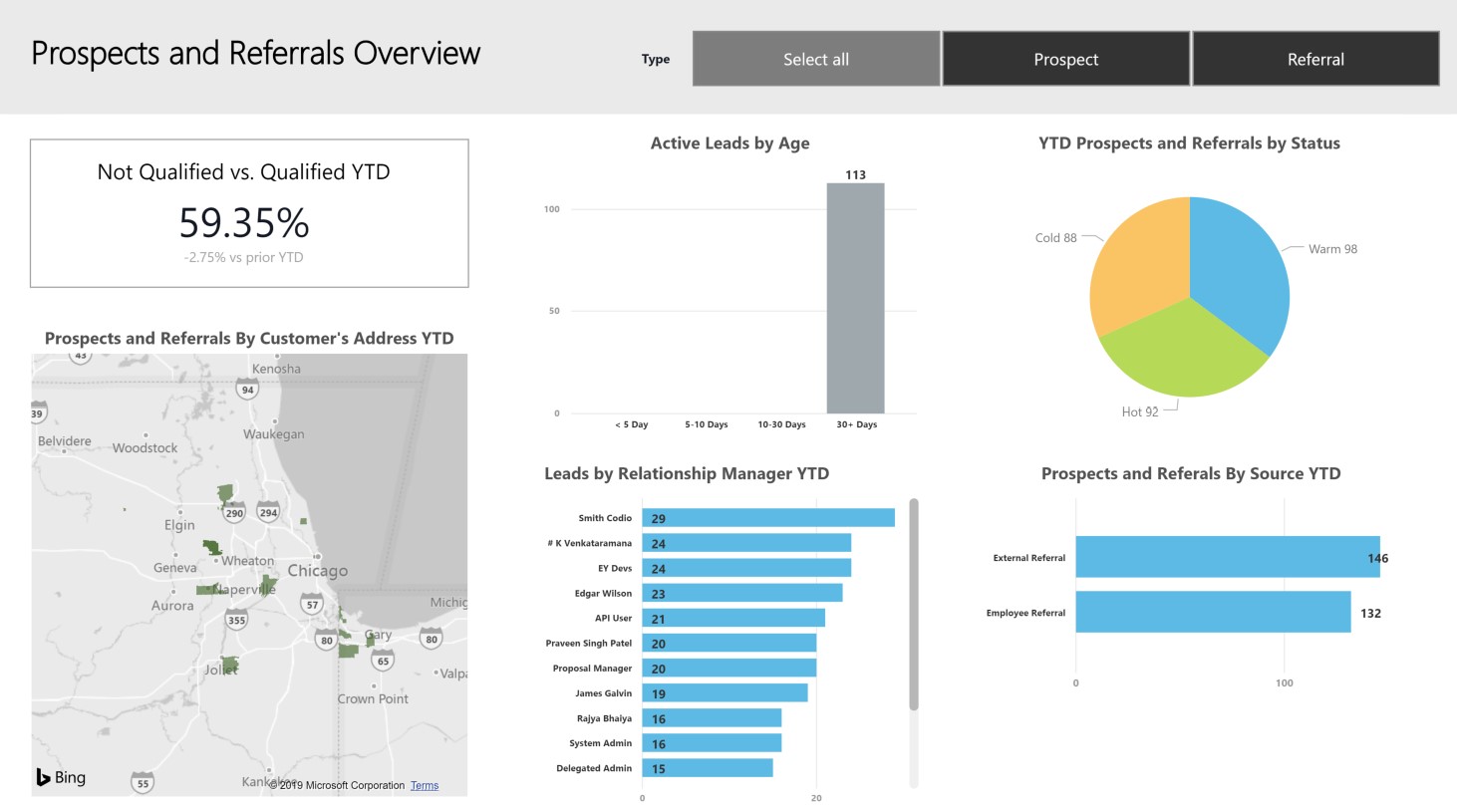

Some of the entities included in the model include Bank, Branch, Collateral, Financial Product, Syndicate (Loan) and Opportunity. Workflows that have been released in the accelerator include Customer On-Boarding, Know Your Customer, Certificate of Deposit and Mortgage Application. Available Dashboards include a Retail Relationship Manager Dashboard, Daily Dashboard and a Prospects and Referrals Dashboard.

To get started using the Banking Accelerator, it can be installed within an existing Dynamics 365 for Sales instance or within a PowerApps environment if you are not using Dynamics 365. The base solution has no dependency for Dynamics 365; however, there are additional extensions that require Dynamics 365 for Sales including the Commercial Banking, Retail Banking and the extension with enhanced scenarios for the customer experience.

Documentation and sample code for the Banking Accelerator is available in GitHub. This includes instructions for installing the accelerator, a walkthrough of the personas and workflows within the accelerator, sample code for extending the accelerator through the Common Data Service Intelligence Platform, sample code for interacting with the Dynamics 365 API, sample code for building Power Apps Canvas and model-driven UI experiences and sample code for extending the accelerator through Azure ML, Cognitive Services and other Azure related services.

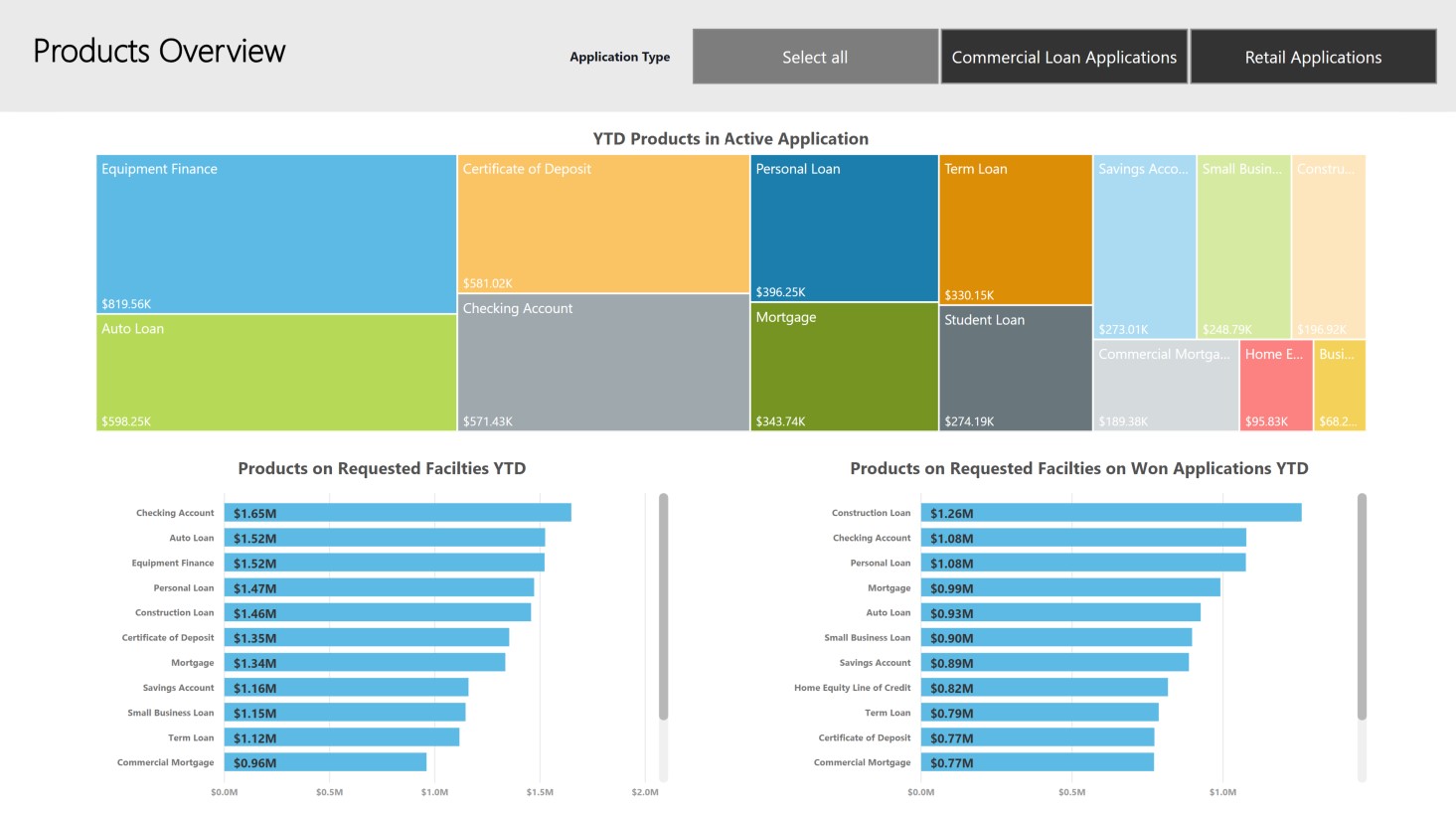

Also available is a sample Power BI Desktop file with a model that consumes the Banking Accelerator entities. The file contains reports focused on commercial and retail loan applications, application statuses, an overview of prospects and referrals and an overview of banking products. Here are a few screenshots of the sample reports:

Contact us for assistance working with the new Dynamics 365 Banking Accelerator or for help with your next Power Platform project.