“Increasing customer retention rates by 5% increases profits by 25% to 95%.” – Harvard Business Review[1]

Reading this statistic in Frederick F. Reichheld and Phil Schefter’s “The Economics of E-Loyalty” article from the Harvard Business Review, I was surprised that such a minor tweak in retention could have such a major impact on profits. The economic experts went on to explain that loyal customers buy more and refer new customers, solidifying the importance of long-term customer relationships.

While we know winning a new customer’s business is difficult and costly, keeping long-established clients has its own set of challenges. Predicting and understanding customer churn take some of the guesswork out of customer retention. By studying behaviors of clients who have churned in the past, and looking at current customers that are behaving similarly, we can take action to positively affect their retention. This can be achieved by establishing a targeted plan that nurtures loyalty in every one of your customers.

Key Benefits, Facts, & Insights

- Boost Profits: Selling to existing customers is easier and more cost effective rather than selling to new ones.

- Retain More Customers: Proactively launch campaigns and strategies to abate customer attrition.

- Win Back Business: Identify the root causes as to why customers leave and establish re-acquisition strategies.

- Avert Loss: Customer loss is substantial, long-reaching, and can impact everything from revenue to opportunity for competition.

Where to Begin…

Whether your customers are people or businesses, and no matter if you’re selling products or services, the problem is still the same: Keeping current customers while continuing to grow with new ones. This means understanding who is no longer a buyer and why they’ve chosen to leave. Once you have the answers, you can work on your retention practices to prevent similar losses in the future.

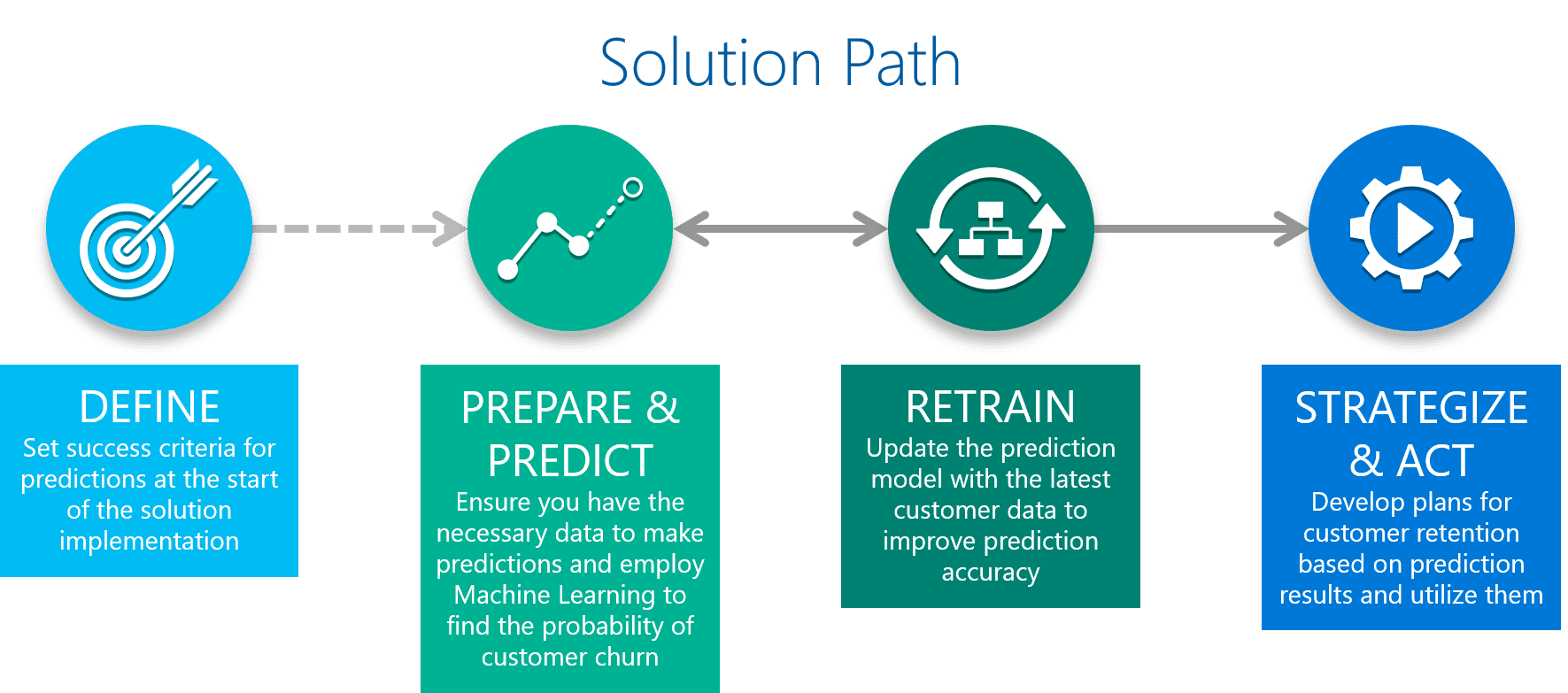

Knowing who is no longer purchasing from you is easy. The mystery lies in knowing which active clients you may lose. Predicting which of current customers are exhibiting behavior like your “previously-churned” customers is the best way to tackle the problem. However, doing this by hand would prove to be highly complex. Using the power of Machine Learning and Microsoft Azure, your historical customer data will be put to work to accurately predict future churn.

We’re using our Customer Churn Solution to help organizations utilize their historical customer data to target at-risk customers and find opportunities to bring back those who’ve left.

|

|

Putting the Predictions to Use

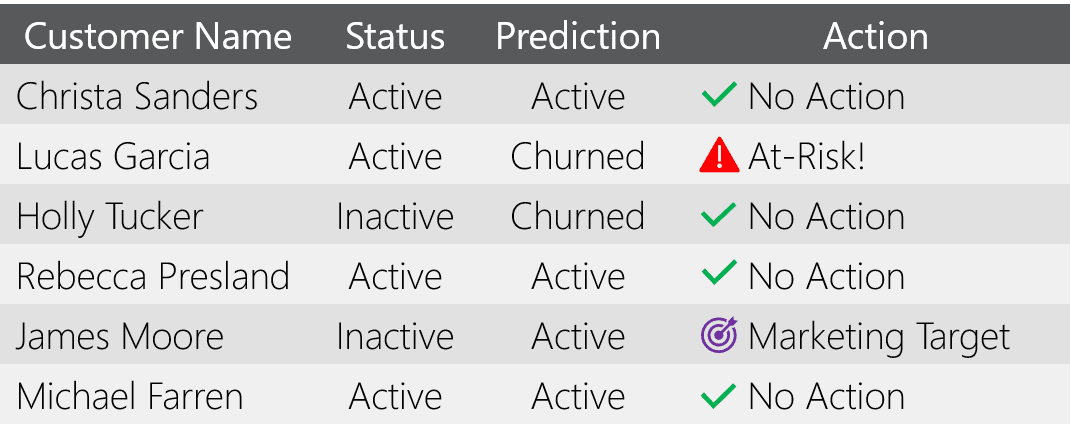

Our goal is to give your company a targeted set of actions to improve customer retention. Once an accurate model has been trained, all of your past and present customers will be run through the predictive model. This could give one of three results. See the table below:

BlueGranite’s Customer Churn prediction also enhances reporting by providing account managers with a list of clients to target with retention efforts, and identifying the best former prospects to try and win back. These crucial insights maximize customer preservation and accurately pinpoint marketing efforts.

Want to Learn More?

Interested in learning more about customer churn, but not sure where to go? Here are a few more resources to point you in the right direction:

- Check out BlueGranite’s Customer Churn Solution Offering for more details on how we can help you implement this type of prediction tool.

- Register for our October 26th Customer Churn Webinar.

- Contact us to learn how BlueGranite experts can help to design a solution to meet your unique needs.