We’ve all experienced the crazed Costco lines to grab the latest shipment of toilet paper. The pandemic had a significant impact on raw materials, labor and logistics; however, some of the demand volatility was driven by unpredictable human behavior. Panic buying and hoarding sent “false” signals of demand that drove up inventory orders. Other products were impacted by both demand and production volatility. Some companies that paused manufacturing operations during the pandemic are now facing accumulated open orders and increased demand due to the economic recovery. The bullwhip effect, by definition, occurs when even small changes in demand cause significant supply chain inefficiencies. I liken the cycles to my kids’ ever-changing food cravings/preferences and on-hand pantry items. One month they are eating cereal every day, the next bananas. I’m left with a month’s supply of cereal in my pantry. These are real life examples of the challenges around the magical mix of supply and demand. The impact of these demand signals is only magnified as it moves through the supply chain (e.g., lowest level suppliers). Careful consideration of the dynamics of demand along with the uncertainty around the demand we forecast is needed for strong supply chain management.

Manufacturing and retail industries have been adapting to direct-to-consumer market pressures for years, but much of the focus has been placed on operational efficiency and lean inventory management. Companies have managed the supply chain through the lens of cost optimization; yet, as the pandemic has shown, there is another side of the equation: customer service. Nothing is worse than ordering a product and receiving a delayed delivery notice. End-to-end supply chain visibility has become a critical component of the customer experience. The focus is shifting from reduction in supply chain cost to building resiliency and adaptability.

According to a recent Sullivan & Frost study, enhancing customer relationships tops the list of manufacturers’ goals for 2021. Top performers are more committed to spending the money and effort needed to make the supply chain more resilient, with 40% saying they are duplicating key suppliers to create redundancy and one-third are bringing more business processes in-house. Companies that invested in supply chain innovation and digitization see an opportunity to flip the business model to compete on customized service capabilities. By 2024, as many as 75% of customer-facing manufacturers’ supply chains will manage customization at scale.

Companies with sophisticated supply chain analytics capabilities aim to achieve near real-time supply chain ecosystems that optimize system integration, automation, and logistics – even across brownfield assets and equipment. Newer technologies like Azure IoT Edge and Digital Twins offer exciting promise for digital innovation as well. The opportunity to realize value from supply chain analytics is significant, especially if you consider the insights gained by integrating your supplier data into your end-to-end digital feedback loop.

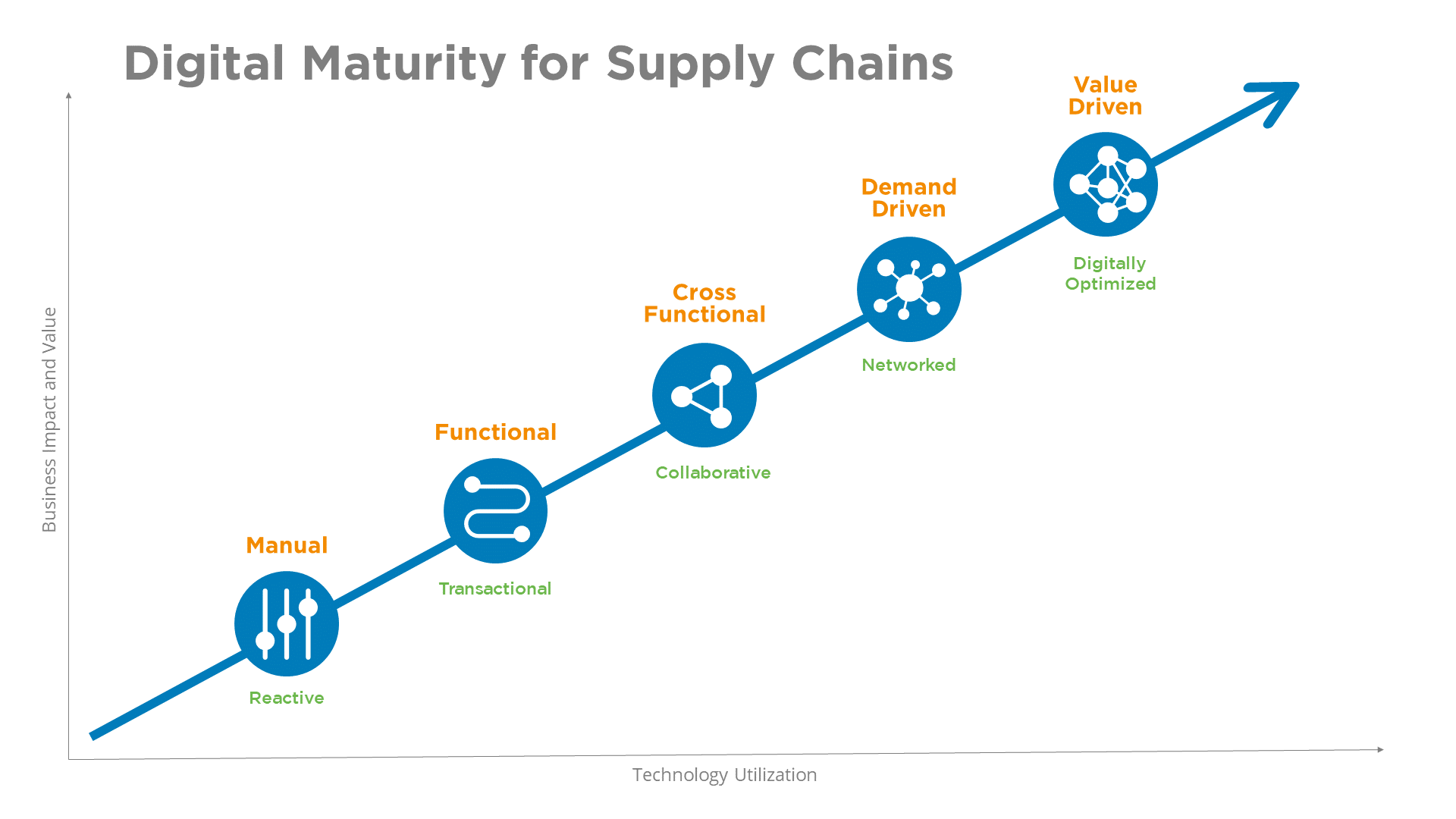

Exhibit A provides a simplistic Analytics Maturity Curve based off Gartner’s 2021 Supply Chain Analytics Scorecard.

Yet, it’s estimated that as few as 11% of companies have digitally mature supply chains (2020 digital supply chain survey, which was a collaborative research initiative conducted by Grant Thornton, the Manufacturing Leadership Council and the National Association of Manufacturers). As many as 2/3 of companies are still using Excel for Supply Chain Management (SupplyChainDive 2018 referencing Adelante SCM and CSCMP 2020 online global study).

Many supply chain organizations aiming to invest in analytics initiatives are struggling to know where to start. 3Cloud’s Catalyst Framework is built on our “Think Big, Start Small” philosophy, focusing on use cases that deliver quick wins.

There are three supply chain initiatives that offer the biggest value relative to effort, in order of priority:

Demand Forecasting

Improving your ability to predict demand using your key sales systems should be the top priority.

Manual and statistical approaches to forecasting are time consuming and produce less accurate results than machine learning (ML) models due to risks associated with data variations, unintended bias, and human error. Even small improvements in demand forecasting can lead to sizable reductions in inventory costs. When artificial intelligence (AI) and ML are applied to demand forecasting, it not only analyzes statistical input, such as historical sales order data, but also identifies internal and external factors that can contribute to “noise” in the demand signal(s) caused by anomalies, like the demand spikes we have seen during the pandemic. Machine learning is also more responsive to changes in demand patterns because the algorithms can be trained to automatically calculate updated forecasts.

Another option to consider for improved demand forecasting is Databricks’ Demand Forecasting Solutions Accelerator, which allows companies to take advantage of popular AI and ML models within a low-code environment, but also gives the flexibility to build out and scale to any company’s needs. 3Cloud can help if you’d like more information about one of these pre-built models that can be tested during a QuickStart engagement.

Supply Chain Visibility

Supply chain visibility involves the ability to track, monitor, and easily report on all stages of supply chain management from procurement of materials from suppliers to the delivery of finished goods to customers. Improved supply chain visibility leads to better outcomes and collaboration, ultimately building more resiliency and adaptability in your supply chain ecosystem. The better visibility you have across finance, inventory, logistics, quality control and operations, the better you can identify and respond to risks and opportunities.

With convergence of manufacturing digitization (e.g. IoT, sensor data, etc.) and cloud-enabled technologies like Azure Synapse and Databricks Lakehouse, full supply chain visibility is within reach. Companies are moving to modern data platforms to capitalize on a cloud environment that supports both real-time analytics and structured reporting, opening the door for data scientists and analysts alike. The ability to ingest varied data types at potentially very large volumes (4 TB is now common) offers the opportunity to be in-touch with all data points, allowing the added benefit of “unsupervised learning” with AI. In other words, you have the ability to apply AI models with data that intersects all aspects of your business with no real expected outcomes. When you do that, you find correlations in your data that will sometimes surprise you. For instance, you might find a direct correlation between lowest cost production runs and highest amount of product returns. Since your plant production runs are weeks (if not months) ahead of when you are cataloging customer returns, it’s rare that you would analyze those two data points.

Think big, start small – remember to start with one possible use case. You can realize a lot of value by integrating your ERP system with just one key subject area like finance or inventory. With good architecture, you can build on your efforts over time. Developing a roadmap for careful consideration of company goals, priorities, and initiatives is always a good idea.

Contact Us

3Cloud offers a variety of resources to help you learn how you can leverage Modern Data Analytics. Please visit our website to learn more, or contact us directly to see how we can help you explore your about modern data analytics options and accelerate your business value.