The high-growth Financial Services industry is vital to the modern economy. It allows consumers to save and borrow money, provides capital for companies to invest in their futures, offers clients advice on investment vehicles, and supports risk management of various life and corporate events through insurance. This multifaceted economic sector is core to keeping society functioning and progressing.

Because Financial Services touches so many aspects of most lives and business organization, it can collect and leverage data at an astonishing pace – and it should. Particularly, with an abundance of choice among industry providers, individual and enterprise clients are now unforgiving towards mistakes, be it inaccurate information resulting in higher loan rates, or tardy money movement causing lost investment opportunities. It is crucial for Financial Services firms to be at the forefront of the data and analytics game; ensuring data integrity, increasing processing speed and accuracy, and reaping the rewards of advanced analytics tools and techniques, including streamlined operations and superior products.

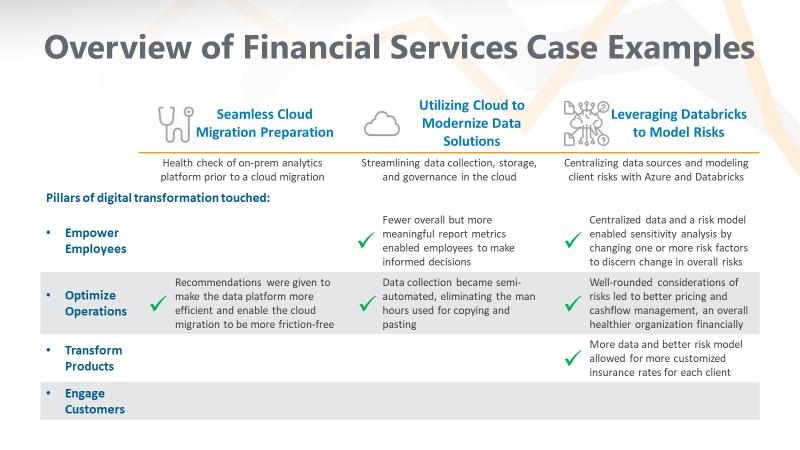

With a strong history of serving Financial Services clients and their data analytics needs, we have deep expertise in delivering technological solutions that help Financial Services firms realize their analytical visions, no matter what stage of the journey they are in. The summaries below highlight three real-world digital transformation strategies in the Financial Services industry provided by us. Read on to discover how we helped these enterprises begin reimagining the way in which they serve their stakeholders and provide marketplace value.

Seamless Cloud Migration Preparation

A global insurer was ready to migrate its data to cloud, both to lower operating costs (e.g., from data storage and administration) and to increase analysis speed. However, without prior experience, it sought guidance as to where to begin the migration journey. Because harmonious data migration requires a solid foundation, we proposed and conducted a thorough assessment of the enterprise’s existing analytics and reporting platform, architecture, and performance.

The customized assessment identified whether users were appropriately leveraging the organization’s platform capabilities; if the platform’s performance efficiency and stability could be further enhanced; and when, where, and how to make data warehouse improvements. The proactive health check gave the insurer the opportunity to confirm that the original platform was well-designed, minimizing the errors that can surface from a cloud migration.

Utilizing Cloud to Modernize Data Solutions

As the client base of a national consumer bank increased, so did the data it needed to screen (e.g., for checks, loans, and wire transfers) and the performance metrics it had to monitor. The bank’s day-to-day functions and supervision became increasingly burdensome and ineffective as the volume of data exponentialized, while the monitoring of it remained manual. Additionally, with over 600 metrics to examine, leadership had a hard time identifying relevant numbers to base decisions upon. Upon understanding the existing technology and business situations, we:

- utilized Microsoft Azure tools, such as Azure SQL Database, to streamline and automate the bank’s data collection, storage, and governance process – allowing business users to easily and quickly access data and report metrics.

- worked with the business to identify a manageable and meaningful set of metrics to monitor and define a series of Power BI reports – allowing executive leadership and analysts to analyze at the appropriate and desired granularity.

By focusing on the needs of the business users, we built an end-to-end data solution that provided fast, accurate, and relevant information.

For more context and technical details on this case, see this solution brief.

Leveraging Databricks to Model Risks

We are currently leading an international insurance provider through a multiyear data and analytics overhaul that will improve its operational efficiency, increase its profitability, and enable scalability of its business. To date, we have helped the insurer centralize and model necessary data for the underwriting process in the cloud. Traditionally, such data had been fragmented and stored on-prem across geographies, business groups, technologies, and use cases. Centralizing the data and revamping the model virtually using Databricks has allowed analysts, actuaries, and policy writers at the bank to quickly and holistically:

- Access clients’ risk factors

- Simulate natural disaster risk over a longer time horizon (100k years vs. the previous 10k years)

- Conduct sensitivity analysis through modifying different risk factors, and

- Determine the optimal rates to offer and policies to adjust

Such ability leads to a more customized offer for each client, meaning more profitable pricing and better cashflow management (e.g., identifying timing for insurance payouts).

Outside of the specific use case of underwriting, we are also helping to ensure the scalability of the client’s data operations by scaling the use of cloud storage and Databricks across the organization. Additionally, we are enabling further modeling and computing capabilities by mapping out the right Platform as a Service (PaaS) tools in Microsoft Azure to the appropriate use cases. Eventually, we will also assist with the creation of captivating data visualization and UI through Power BI, ensuring the results of any data modeling and analyses can be meaningfully conveyed.

The figure below provides an overview of the three cases above and how the pillars of Digital Transformation are touched by each case:

We look forward to serving all those in the industry with a need or desire to further capitalize the potential of data. Contact us today to learn more.